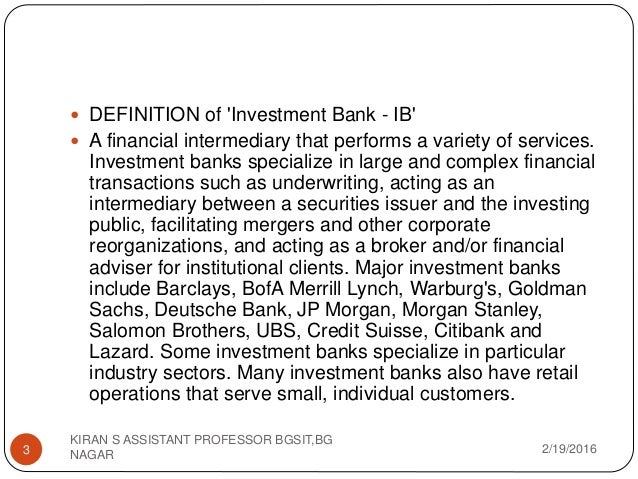

Definition Of Investment Banks. Investment bank definition is - an institution that specializes in buying and selling large blocks of securities (as new issues) and in raising funds for capital expansion. Definition: Investment banking is a special segment of banking operation that helps individuals or organisations raise capital and provide financial consultancy services to them.

Investment banks help companies develop their investment portfolios and expand access capital.

Investment banking is the division of a bank or financial institution that serves governments, corporations, and institutions by providing underwriting (capital raising) and mergers and acquisitions (M&A) advisory services.

Investment bank definition: a bank engaged primarily in making long-term loans to companies and managing investment. The industry is flooded by large and small investment banks. Investment bank definition is - an institution that specializes in buying and selling large blocks of securities (as new issues) and in raising funds for capital expansion.

/What-Is-an-Investment-Bank-Definition-56a092c83df78cafdaa2d616.jpg)